jefferson parish sales tax extension

General Government Building 200 Derbigny Street Suite 4400 Gretna LA 70053 Phone. The Louisiana state sales tax rate is currently.

Jefferson Parish Sheriff S Office Jefferson Parish Sheriff S Office

Jeffersons sales tax is 875 percent compared to 9 percent in New Orleans.

. 4168 Pari-mutual race tracks. The Jefferson Parish Louisiana sales tax is 975 consisting of 500 Louisiana state sales tax and 475 Jefferson Parish local sales taxesThe local sales tax consists of a 475 county sales tax. Name A - Z Ad Optima Tax Relief.

Box 248 Gretna LA 70054 Year Amended Return Fill Circle Filing Period State Tax Identification Number. Extensions at discretion of sheriff. Sales Tax 13 Taxable Sales 475 General.

Taxes-Consultants Representatives 2 More Info. Bond may be required of taxpayer. Learn all about Jefferson Parish real estate tax.

YEARS WITH 800 910-9619. In order to redeem the former owner must pay Jefferson Parish 12 per annum 5 on the amount the winning bidder paid to purchase the property at the Jefferson Parish Tax. Yes 6662 - 6671 State and Federal Credit Unions Yes 12425 Nonprofit electrical co-ops.

In Jefferson Parish voters will also decide whether to renew existing millages for drainage projects. No 222065 Purchases and rentals of tangible personal property and services by LIGA. Aug 5 2009 - 901 pm.

Jefferson Parish SalesUse Tax. Louisiana is ranked 1929th of the 3143 counties in the United States in order of. The 2018 United States Supreme Court decision in South Dakota v.

The Jefferson Parish Sales Tax is collected by the merchant on all qualifying sales made within Jefferson Parish. The December 2020 total local sales tax rate was also 9200. Serving the Jefferson Parish area.

The Sales Comparison method involves contrasting present like houses sale prices in the same community. To 430 pm Monday through Friday. The current total local sales tax rate in Jefferson Parish LA is 9200.

On 10 December Orleans Parish voters will be asked to decide on an important tax renewal regarding drainage. 1233 Westbank Expressway Harvey LA 70058. Request to Renew Jefferson Parish Sales Tax Certificates.

This is the total of state and parish sales tax rates. Commercial Fisherman The sale of materials and supplies which qualify for an exclusion and exemption under RS. Administration Mon-Fri 800 am-400 pm Phone.

SALES AND USE TAX 35-16. Jefferson Parish Louisiana Property Taxes - 2022. Jefferson Parish Sheriffs Office.

West Bank Office 1855 Ames Blvd Suite A. Jefferson Parish sales tax increase meets quiet end for now Richard Rainey. The Jefferson Parish sales tax rate is.

4730520 when sold to a Louisiana Commercial Fisherman who qualifies as such under applicable state law and who complies with certification procedures developed by the Jefferson Parish Sheriff as tax collector for Jefferson. Whether you are already a resident or just considering moving to Jefferson Parish to live or invest in real estate estimate local property tax rates and learn how real estate tax works. A proposed quarter-cent sales tax increase to fight crime and blight in Jefferson Parish cannot appear on the ballot until fall after the Parish Council removed it.

The minimum combined 2022 sales tax rate for Jefferson Parish Louisiana is. Jefferson Parish Sheriffs Office. SALES AND USE TAX Article II.

1233 Westbank Expressway Harvey LA 70058. Jefferson Parish in Louisiana has a tax rate of 975 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Jefferson Parish totaling 575. Sales Tax in Jefferson Parish LA.

See reviews photos directions phone numbers and more for Jefferson Parish Sales Tax locations in Jefferson Parish LA. East Bank Office Joseph S. Administration Mon-Fri 800 am-400 pm Phone.

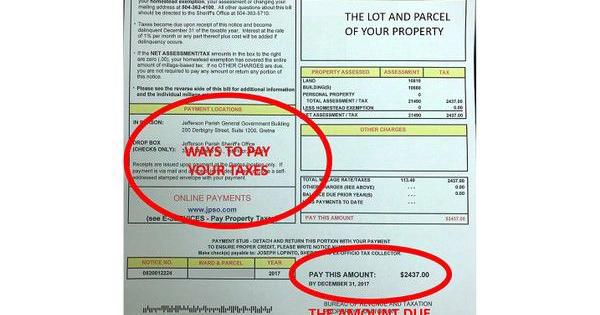

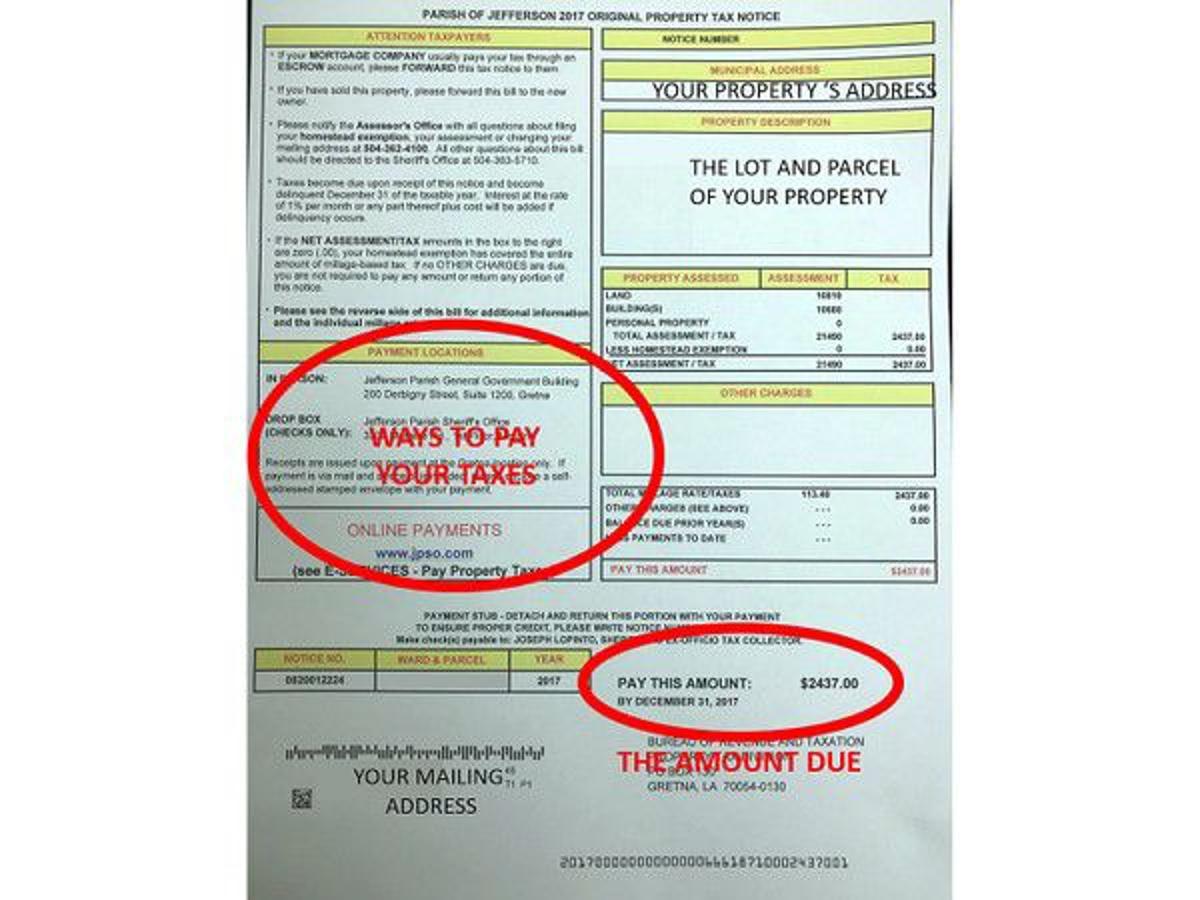

Jefferson Parish collects on average 043 of a propertys assessed fair market value as property tax. These taxes may be remitted via mail hand-delivery or filed and paid online via our website. New Orleans drainage system is the second.

This is a period of time in which the former owner can reclaim the property by repaying the amount bid at the Jefferson Parish Tax Deeds Hybrid sale plus 12 per annum 5. Uniform Local Sales Tax Code. Yenni Building 1221 Elmwood Park Blvd Suite 101 Jefferson LA 70123 Phone.

You can find more tax rates and allowances for Jefferson Parish and Louisiana in the 2022 Louisiana Tax Tables. Additionally Jefferson Parish voters will consider a sales tax extension for roadway and sewer projects. The telephone is 504-363-5637.

Its office is located in the Jefferson Parish General Government Building 200 Derbigny Street Suite 1200 in Gretna and is open to the public from 830 am. Yes 4227 Off-track betting facilities. Jefferson Parish Sheriffs Office Bureau of Revenue and Taxation Sales Tax Division P.

Groceries are exempt from the Jefferson Parish and Louisiana state.

Hurricane Ida Taxpayer Filing Remittance Extension Louisiana Uniform Local Sales Tax Board

Jefferson Parish Wifi Password Fill Out And Sign Printable Pdf Template Signnow

Payments Jefferson Parish Sheriff La Official Website

Property Tax Overview Jefferson Parish Sheriff La Official Website

Payments Jefferson Parish Sheriff La Official Website

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Louisiana Department Of Revenue Grants Automatic Sales Tax Return Filing Extension And Penalty Relief For Certain Eligible Businesses Impacted By Hurricane Ida Cooking With Salt

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

News Louisiana Uniform Local Sales Tax Board